AutoPay Help

- How can I enroll in AutoPay?

- Why can I not select a due date with 12 installments?

- Why can I not select a due date of the 29th, 30th or 31st?

- What payment methods are supported by AutoPay?

- Will I receive paper invoices when enrolled in AutoPay?

- Will a manual payment stop the AutoPay withdrawal?

- If I have multiple policies, do I need to enroll/unenroll each policy on AutoPay?

- How do I locate my bank routing number and checking account number?

- How can I be sure that my information is secure and protected?

- What is PCI Compliance and why is it so important?

How can I enroll in AutoPay?

AutoPay is Safety Insurance's automatic premium-payment withdrawal program. For policies that are eligible, 5, 10 or 12 recurring monthly installments may be selected. Being enrolled in AutoPay provides the benefit of a reduced monthly installment billing charge.

How to sign up for Safety Insurance's AutoPay

Why can I not select a due date with 12 installments?

When choosing 12 installments, the withdrawal date automatically defaults to the same day of the month that the policy is effective. For instance, if a policy is effective on 1/22/2022, choosing 12 installments means that withdrawals will occur on the 22nd of each month. If having the choice of withdrawal date is preferred, we suggest selecting 10 installments instead.

Why can I not select a due date of the 29th, 30th or 31st?

The 29th, 30th or 31st are not available as not every month contains those dates.

What payment methods are supported by AutoPay?

You can enroll in AutoPay using a checking or savings account. Credit or debit cards are not eligible for AutoPay.

Will I receive paper invoices when enrolled in AutoPay?

No, you will receive notification via email associated with your My Account when your invoice is available for viewing online. If you prefer, you may print a copy for your records.

Will a manual payment stop the AutoPay withdrawal?

Manual payments made at least 3 business days prior to a scheduled withdrawal date may prevent the AutoPay payment. For additional details, please contact Safety Insurance during normal business hours

If I have multiple policies, do I need to enroll/unenroll each policy on AutoPay?

Yes, each individual policy would need to be separately enrolled or unenrolled in AutoPay. Likewise, if banking information needs to be changed, please update all policies accordingly.

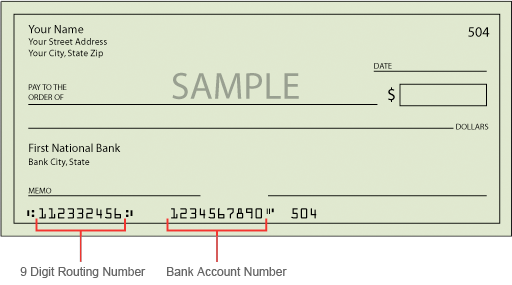

How do I locate my bank routing number and checking account number?

A bank routing number is a unique nine-digit number that identifies a financial institution and is found at the bottom a check. The checking account number is found to the right of the bank routing number. It is important to note that the numbers on a deposit slip may not be the same as the numbers found on a check, so please be sure to use a check to obtain this information.

Personal Check

Business Check

How can I be sure that my information is secure and protected?

Safety uses Invoice Cloud to process payments. Invoice Cloud complies with all PCI (Payment Card Industry) security standards to keep your personal information secure. This means that you can pay online with confidence that your data is protected. Account information displayed within Invoice Cloud's payment portal is truncated to protect confidential data. The portal uses encryption and other security protocols that prevent third parties from reading or accessing your information while it is being processed.

What is PCI Compliance and why is it so important?

PCI stands for Payment Card Industry, and compliance with the industry standards is a requirement for those that accept the major credit cards and for software providers who have applications which involve the transmission and/or storage of credit card information.