Bill Pay Help

- What options are available to pay my bill?

- What is Safety’s Online Bill Pay service?

- Who can use Safety’s Online Bill Pay service?

- What happens if my Online Bill Pay payment is returned unpaid by my financial institution?

- Do I need to provide an e-mail address and/or telephone number?

- Can I make a partial payment or pay more than the minimum amount due?

- Can I make more than one payment each month?

- When will my payment be reflected?

- Why do I need a Confirmation Number?

- What happens if there is a mistake or issue with my online payment?

- How can I change my saved banking information?

What options are available to pay my bill?

- One-time payment through Safety's Online Bill Pay service on SafetyInsurance.com via My Account or Guest Pay

- Safety Mobile App

- Pay by Phone 1 800 951-2100

- Enroll in AutoPay

- Mail a check or Money Order to: Safety Insurance PO Box 371312 Pittsburgh, PA 15250-7312

What is Safety’s Online Bill Pay service?

Safety’s Online Bill Pay is a payment service that offers policyholders the added convenience of paying their insurance premium online. You may make an online electronic check (ACH) payment free of charge. Online payments made by credit or debit card will be assessed a fee of $4.95 by Invoice Cloud, a third-party payment processor. Online Bill Pay is available 24 hours a day, 7 days a week.

Safety Insurance accepts the following as valid forms of payment:

- Personal or business checking accounts drawn on US banks

- MasterCard, Visa, and Discover credit cards

- Debit cards

Note: Payments from foreign bank accounts and savings accounts are not considered valid forms of payment.

Who can use Safety’s Online Bill Pay service?

All policyholders may use Safety’s Online Bill Pay service as a guest by entering their policy number and zip code. Policyholders that sign up for My Account will be able to use advanced features, such as saving payment information, scheduling payments for a future date, and receiving alerts. Please note that in addition to combined bill accounts, payment is accepted for all policy types.

What happens if my Online Bill Pay payment is returned unpaid by my financial institution?

Online Bill Pay transactions that have been returned unpaid by your financial institution will be reversed and a returned payment fee as specified on your bill will be added to the policy or combined bill account balance.

Do I need to provide an e-mail address and/or telephone number?

Yes. A valid email address and day-time telephone number is required as a condition of using Online Bill Pay. We will use this information only in the event that we need to contact you regarding your payment.

Can I make a partial payment or pay more than the minimum amount due?

Yes. Payments will be accepted for any amount up to and including the balance due with the following exceptions:

- $125,000 maximum daily payment amount for personal and business checking accounts

- $10,000 maximum daily payment amount for ATM debit/debit/credit cards

Can I make more than one payment each month?

Yes, you may use Safety’s Online Bill Pay service many times throughout the month. The exception is that only one payment transaction of the same amount will be accepted per day for the same policy or combined bill account in order to prevent unintended, duplicate transactions.

When will my payment be reflected?

Electronic payments may take up to 2 business days to post to your account. If you have received a notice of cancellation for non-payment of premium, please refer to the notice of cancellation and contact your agent immediately if your payment will not post prior to 12:01am on the effective date of your cancellation.

Business days are when both Safety and our bank are open for business.

Why do I need a Confirmation Number?

A confirmation number is provided as evidence that an Online Bill Pay transaction has been submitted. The confirmation number will be provided when the transaction has been completed as well as referenced in the notification sent to you at the email address provided during your transaction. You will find the confirmation number as part of the Payment Message.

What happens if there is a mistake or issue with my online payment?

If you believe that an error or problem has occurred with your Online Bill Pay transaction, you may contact Safety Insurance at (800) 951-2100 ext. 3200, between 8:15 am and 7:00 pm Monday through Friday. Please have your policy or combined bill account number available when you call.

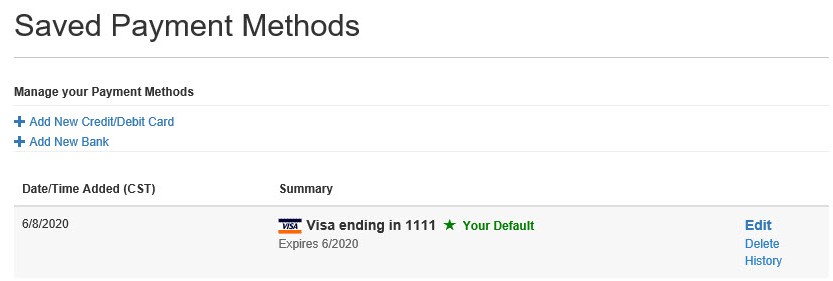

How can I change my saved banking information?

When paying your bill on Invoice Cloud's webpage, go to the "My Profile" drop down menu and select 'Payment Methods' to edit or delete your saved payment information.